All Categories

Featured

The kid cyclist is acquired with the notion that your kid's funeral service expenses will be fully covered. Kid insurance cyclists have a survivor benefit that varies from $5,000 to $25,000. When you're grieving this loss, the last point you need is your debt including complications. To purchase this biker, your child has their own standards to satisfy.

Your child has to also be between the ages of 15 days to 18 years old. They can be covered under this strategy until they are 25 years of ages. Additionally, note that this plan only covers your youngsters not your grandchildren. Last expenditure insurance coverage benefits do not end when you join a policy.

Bikers can be found in various kinds and present their own advantages and rewards for joining. Bikers are worth checking out if these supplementary choices put on you. Motorcyclists consist of: Faster death benefitChild riderLong-term careTerm conversionWaiver of costs The accelerated fatality benefit is for those that are terminally ill. If you are seriously sick and, relying on your particular plan, identified to live no longer than 6 months to 2 years.

The Accelerated Fatality Benefit (in most instances) is not strained as income. The downside is that it's mosting likely to minimize the survivor benefit for your beneficiaries. Getting this additionally needs proof that you will not live previous six months to two years. The child biker is acquired with the concept that your kid's funeral expenditures will be fully covered.

Insurance coverage can last up till the kid transforms 25. Likewise, note that you may not be able to authorize your kid up if she or he deals with a pre-existing and deadly problem. The long-term care motorcyclist is comparable in concept to the increased survivor benefit. With this one, the concept behind it isn't based upon having a short amount of time to live.

As an example, someone that has Alzheimer's and requires everyday assistance from health and wellness assistants. This is a living benefit. It can be borrowed against, which is extremely helpful due to the fact that long-term treatment is a significant expenditure to cover. For instance, a year of having someone deal with you in your house will certainly cost you $52,624.

What Happens At End Of Life Insurance Term

The incentive behind this is that you can make the switch without being subject to a medical examination. cheap funeral policies. And since you will certainly no longer be on the term plan, this likewise means that you no longer have to stress concerning outlasting your policy and shedding out on your survivor benefit

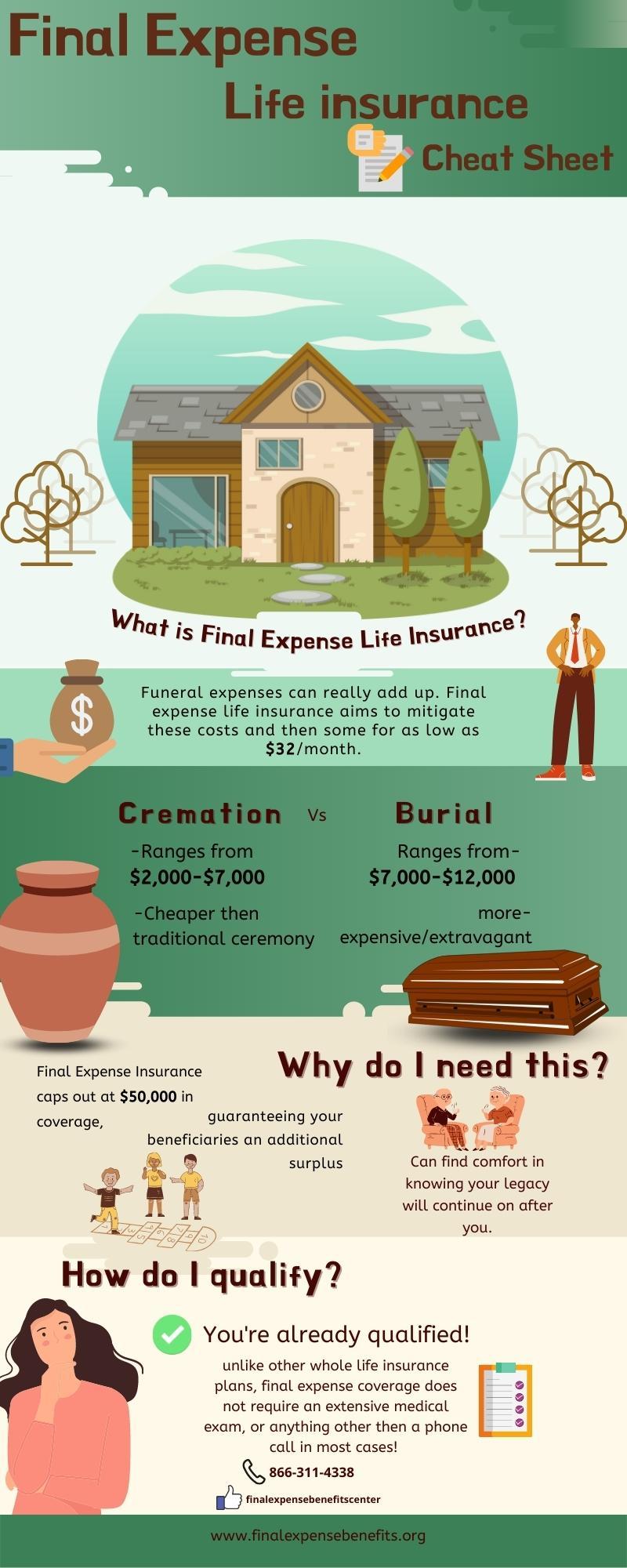

The specific amount relies on various factors, such as: Older individuals normally encounter greater premiums because of enhanced health and wellness risks. Those with existing wellness conditions may run into greater premiums or constraints on protection. Higher protection amounts will normally cause higher costs. Bear in mind, plans normally cover out around $40,000.

Consider the month-to-month premium settlements, however additionally the assurance and monetary security it provides your household. For lots of, the confidence that their loved ones will not be strained with financial difficulty during a challenging time makes final cost insurance policy a beneficial investment. There are two kinds of final cost insurance coverage:: This type is best for people in fairly healthiness that are searching for a means to cover end-of-life prices.

Coverage amounts for streamlined problem policies generally rise to $40,000.: This kind is best for people whose age or health prevents them from purchasing other kinds of life insurance policy protection. There are no wellness requirements at all with ensured issue policies, so anyone who meets the age requirements can typically certify.

Funeral Insurance Comparison Rates

Below are some of the aspects you ought to take into consideration: Review the application procedure for different plans. Make sure the service provider that you pick provides the amount of coverage that you're looking for.

Latest Posts

Life Insurance Or Funeral Plan

Final Expense Network Reviews

Top 10 Final Expense Insurance Companies