All Categories

Featured

Table of Contents

Ideal Company as A++ (Superior; Top group of 15). The score is since Aril 1, 2020 and goes through change. MassMutual has actually obtained different rankings from various other rating agencies. Place Life Plus (And Also) is the advertising name for the Plus biker, which is included as component of the Sanctuary Term plan and provides access to added services and benefits at no expense or at a discount rate.

If you depend on somebody financially, you might ask yourself if they have a life insurance coverage plan. Learn exactly how to locate out.newsletter-msg-success,.

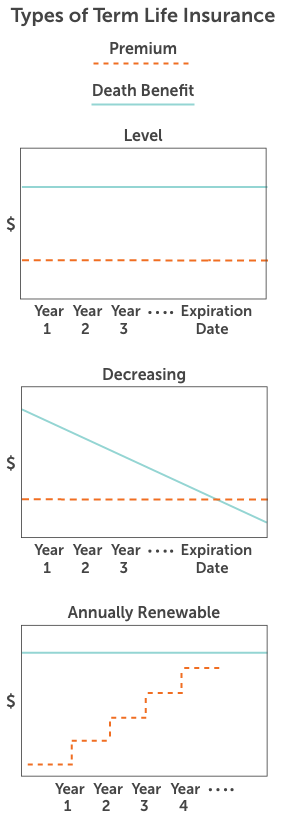

There are numerous kinds of term life insurance coverage plans. Instead than covering you for your entire life-span like whole life or global life plans, term life insurance just covers you for a marked amount of time. Plan terms generally vary from 10 to three decades, although much shorter and longer terms may be readily available.

If you want to keep insurance coverage, a life insurer might provide you the alternative to restore the plan for one more term. If you included a return of costs cyclist to your policy, you would certainly get some or all of the money you paid in costs if you have outlived your term.

What is the most popular Level Term Life Insurance Calculator plan in 2024?

Degree term life insurance policy may be the very best option for those who want protection for a set duration of time and want their premiums to remain stable over the term. This might relate to buyers worried regarding the price of life insurance and those that do not want to change their survivor benefit.

That is because term policies are not guaranteed to pay, while irreversible plans are, provided all premiums are paid. Degree term life insurance policy is typically more pricey than lowering term life insurance policy, where the survivor benefit decreases gradually. Apart from the kind of plan you have, there are a number of other factors that help determine the cost of life insurance coverage: Older applicants typically have a greater mortality risk, so they are normally more costly to insure.

On the other side, you may have the ability to protect a less expensive life insurance price if you open the plan when you're more youthful - What is level term life insurance?. Similar to advanced age, inadequate health and wellness can additionally make you a riskier (and more expensive) prospect forever insurance coverage. However, if the problem is well-managed, you may still have the ability to find economical insurance coverage.

Nonetheless, wellness and age are commonly far more impactful costs factors than sex. High-risk hobbies, like diving and sky diving, might lead you to pay more for life insurance. Risky work, like home window cleaning or tree trimming, may likewise drive up your expense of life insurance policy. The ideal life insurance policy firm and plan will depend on the person looking, their individual rating elements and what they need from their policy.

Level Term Life Insurance Companies

The initial action is to identify what you require the plan for and what your spending plan is. Some companies supply on-line pricing estimate for life insurance coverage, yet lots of need you to get in touch with a representative over the phone or in individual.

One of the most preferred kind is now 20-year term. Many business will not offer term insurance coverage to an applicant for a term that ends previous his or her 80th birthday. If a policy is "sustainable," that suggests it proceeds active for an additional term or terms, approximately a defined age, also if the health of the insured (or various other factors) would cause him or her to be turned down if she or he applied for a new life insurance coverage plan.

Premiums for 5-year eco-friendly term can be level for 5 years, after that to a brand-new price reflecting the new age of the guaranteed, and so on every 5 years. Some longer term policies will certainly guarantee that the premium will certainly not increase throughout the term; others do not make that guarantee, allowing the insurer to raise the rate during the plan's term.

This means that the plan's proprietor can alter it right into a permanent sort of life insurance policy without extra proof of insurability. In the majority of kinds of term insurance, consisting of home owners and auto insurance, if you haven't had a claim under the policy by the time it ends, you obtain no reimbursement of the costs.

Compare Level Term Life Insurance

Some term life insurance policy consumers have actually been miserable at this result, so some insurance companies have created term life with a "return of premium" attribute. The premiums for the insurance policy with this attribute are usually substantially greater than for policies without it, and they typically need that you keep the plan active to its term otherwise you forfeit the return of premium advantage.

Level term life insurance premiums and death advantages continue to be regular throughout the plan term. Degree term policies can last for durations such as 10, 15, 20 or three decades. Level term life insurance policy is typically more economical as it does not develop money value. Degree term life insurance policy is one of the most common sorts of protection.

While the names often are used mutually, degree term insurance coverage has some vital differences: the costs and fatality advantage remain the same for the duration of coverage. Level term is a life insurance policy policy where the life insurance policy costs and survivor benefit continue to be the exact same for the period of coverage.

The length of your coverage duration may depend on your age, where you are in your career and if you have any type of dependents.

What does a basic Level Term Life Insurance plan include?

Some term policies may not maintain the costs and death profit the very same over time. You don't want to incorrectly think you're buying level term protection and after that have your fatality benefit modification later on.

Or you may have the option to transform your existing term insurance coverage right into a permanent plan that lasts the rest of your life. Numerous life insurance policy policies have potential advantages and downsides, so it is very important to understand each prior to you make a decision to buy a plan. There are several advantages of term life insurance coverage, making it a prominent option for protection.

Table of Contents

Latest Posts

What is Increasing Term Life Insurance? Key Considerations?

What is a simple explanation of Cash Value Plans?

What is Increasing Term Life Insurance? Explained in Detail

More

Latest Posts

What is Increasing Term Life Insurance? Key Considerations?

What is a simple explanation of Cash Value Plans?

What is Increasing Term Life Insurance? Explained in Detail